how to lower property taxes in georgia

So for example a typical homeowner in Georgia will pay taxes on the value of his or her house the improvements and the lot. Georgia is ranked number thirty three out of the fifty states in.

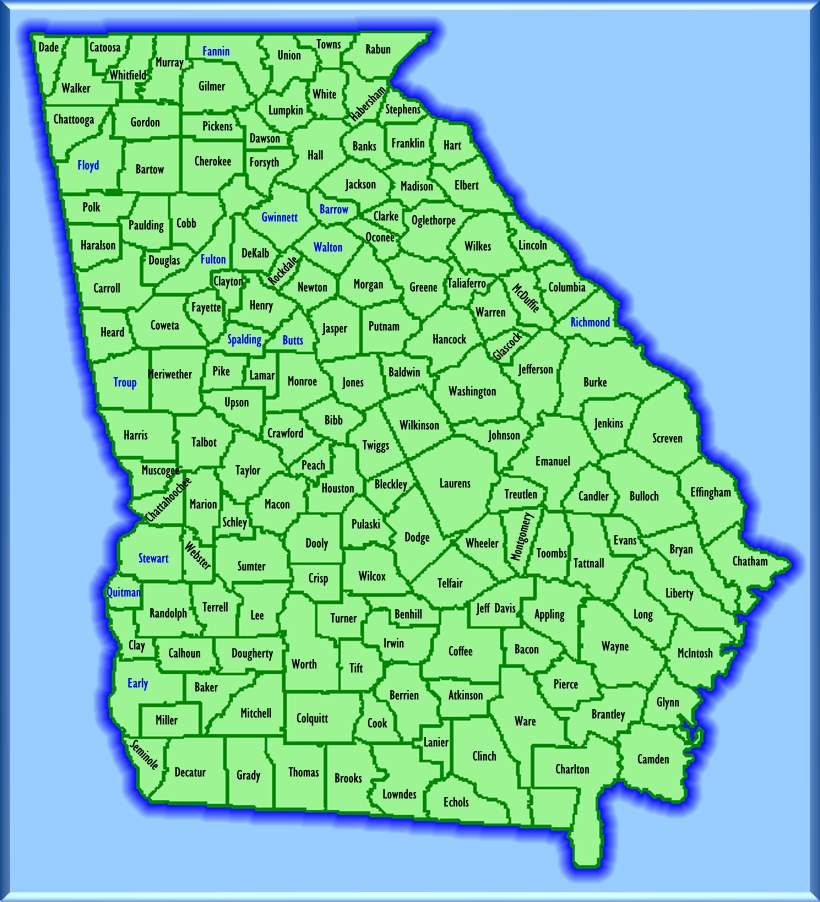

Property Taxes Laurens County Ga

083 of home value.

. Ill be happy to help you find the answers to your questions. My name is Im an attorney. Property Tax Homestead Exemptions.

Verify the property tax record data on your home. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. Tax amount varies by county.

Georgia law allows for reduced property taxes if you and. Counties in Georgia collect an average of 083 of a propertys assesed fair market value as property tax per year. Some cities and local governments in Fulton County collect additional local sales taxes which can be as high as 19.

This does not apply to or affect county municipal or school district taxes. Property Tax Millage. Feel free to ignore if you dont want a call.

Georgia Sales Tax Rates. Georgia Property Tax Rates. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

Georgia is ranked number thirty three out of the fifty states in. If you have ever received a bill that you thought seemed quite inflated from the previous year then you should pay close attention to the reason behind the. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

The government uses the money that these taxes generate to pay for schools public services libraries roads parks and the like. A senior property tax exemption reduces the amount. The lower rate of 9287 mills in the.

New Yorks senior exemption is also pretty generous. Georgia Property Tax Rates. Appeal the Taxable Value of Your Home.

Also you might be offered a phone call but youre under no obligation to accept. County Property Tax Facts. They are generally lower than short-term capital gains tax rates.

Property Tax Returns and Payment. Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and up to 10 acres of land surrounding the residence. Property Taxes in Georgia Property Taxes in Georgia County Property Tax Facts.

When people get their annual notice of assessment in the mail thats when they typically get fired up about lowering their property taxes. The phone call requests dont come from me theyre a pop-up offered by the site. Maintenance on Georgia Tax Center and Alcohol Licensing Portal will occur Sunday May 15 from 9 am to 7 pm.

Read Your Assessment Letter. Heres how to appeal your property tax bill step by step. Mortgage Relief Program is Giving 3708 Back to Homeowners.

Know the assessment value of your home and the deadlines in your jurisdiction. So if your property is assessed at 300000 and. When your new assessment comes in the mail itll list information about your property such as lot size or a legal description as well as the assessed value of your house and land.

You might know that the Georgia tax authorities compute property tax. People who own real property must pay property taxes. The sooner you get the help you need and start to take care of these tax issues to help lower your bill the better you will feel.

Read Your Assessment Letter. Lower Property Tax in Atlanta GA Property Tax Firm Atlanta Georgia. Take Advantage of All Applicable Tax Breaks.

Tax amount varies by county. Check Your Eligibility Today. Upon which it sits the land but the owners possessions the personal property.

Look at Your Annual Notice of Assessment. We are a property tax consulting firm that works to lower the property tax assessment for your commercial or residential property. We are a property tax consulting firm that works to lower the property tax assessment for your commercial or residential property.

Commissioner Shannon Whitfield will sign a resolution next week to reduce the county governments portion of the millage rate for residents in both the unincorporated and incorporated sections of the county. Typically the tax amount is based on a propertys assessed value. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility.

Counties in Georgia collect an average of 083 of a propertys assesed fair market value as property tax per year. Tax assessors rely primarily on public. 083 of home value.

The key piece of information youll want to note on yours is the year-to-year change in your propertys appraised value. There are also a number of property tax exemptions in Georgia that can reduce your homes assessed value and therefore your taxes. If you are a residential or commercial property owner within the Atlanta Georgia area then you may be a candidate for a lower property tax Atlanta notice.

Individuals 65 years or older may claim a 4000 exemption from all state and county ad. These vary by county. The statewide exemption is 2000 but it applies only to the statewide property tax which is a relatively small slice of the overall property taxes in most areas.

We are a property tax consulting firm that works to lower the property tax assessment for your commercial or residential property. Its calculated at 50 percent of your homes appraised value meaning youre only. Tax amount varies by county.

Up to 25 cash back Are You Getting All the Georgia Property Tax Breaks You Deserve. Up to 25 cash back hold a tax sale without going to court called a nonjudicial tax sale or. How to Appeal PropertyTaxes in Georgia.

Capital Gains Tax Rate Filing Single. Local governments periodically assess all the real estate they tax. In addition you can work with a property tax consultant who can help you with appealing the assessed value from the DeKalb County tax assessor if you feel the valuation was too high.

What You Need to Know About Georgia Property Tax Liens How to Avoid Capital Gains Taxes in Georgia. The average effective property tax rate in Georgia is 087. First understand that all property in Georgia ie land improvements and personal property is subject to being taxed unless it qualifies for a specific exemption under state law.

Long Term Capital Gains Tax Rate. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. 23 Apr Tips for Lowering your Property Tax Bill in 2020.

Give the assessor a chance to walk through your homewith youduring your assessment. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help you win it. Up to 25 cash back Hello and welcome to Just Answer.

10 Ways to Lower Your Property Taxes Lower Your Tax Bills. Fulton County A county-wide sales tax rate of 3 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. Counties where we reduce property taxes include Gwinnett County Fulton DeKalb Forsyth Fayette Hall Barrow Walton and any other Georgia county.

Property tax returns must be filed with the county tax office between January 1 and April 1 of each year. Appeal the Taxable Value of Your Home. LaFayette GA For the second year in a row property owners in Walker County will benefit from a tax decrease.

We lower the property tax burden for parcels all across Georgia and the Atlanta area. The property tax system can be confusing. All property in Georgia is taxed at an assessment rate of 40 of its full market value.

Consumer Ed says.

About The Board Of Equalization Georgia

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

What Is A Homestead Exemption And How Does It Work Lendingtree

Historical Georgia Tax Policy Information Ballotpedia

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Tips For Lowering Your Property Tax Bill In 2020 Atlanta Tax

Equitax Georgia Property Tax Appeal Services Tax Liability Reduction

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

2021 Property Tax Bills Sent Out Cobb County Georgia

5 Property Tax Deductions In Georgia You Should Know Excalibur

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Tips For Lowering Your Property Tax Bill In 2020 Atlanta Tax